|

We get asked constantly about the most TAX-FRIENDLY state to transfer residency when you are trying to leave the U.S. (either permanently or temporarily), or in the case of RV explorers and part-time snowbirds, the best state for retirees who only want to spend a few months out of the year in one place and the rest of the year in a warmer tropical climate. Note: This advice is coming directly from our accountant, who also took the plunge and became a digital nomad several years ago and now works remotely year-round. This is not intended to be legal or tax advice, just general advice that anyone can verify themselves. Top 5 Tax-Friendly States for Digital Nomads1. Nevada: Best privacy, no personal income tax, no corporate income tax. Allows anonymous LLCs. Shareholders in a NV corporation can also remain anonymous. 2. Florida: No personal income tax. Does impose a 5.5% corporate income tax. 3. Texas: No personal or corporate income tax, but does levy a gross receipts tax. 4. Alaska: No personal income tax. There is a corporate income tax. 5. Wyoming: No corporate or personal income tax. Our Accountant, Chris: If you plan to live the life of a snowbird or be a digital nomad, the best state to establish residency is Nevada. Nevada has no corporate or personal income tax as well as the best privacy laws. Nevada collects most of its revenue through sales taxes, as well as taxes on the casino and hotel industries. Nevada is the only state that does not share information with any other state or the IRS, and Nevada is one of the few states that allows anonymous LLCs. Shareholders in a Nevada corporation can also remain completely anonymous.

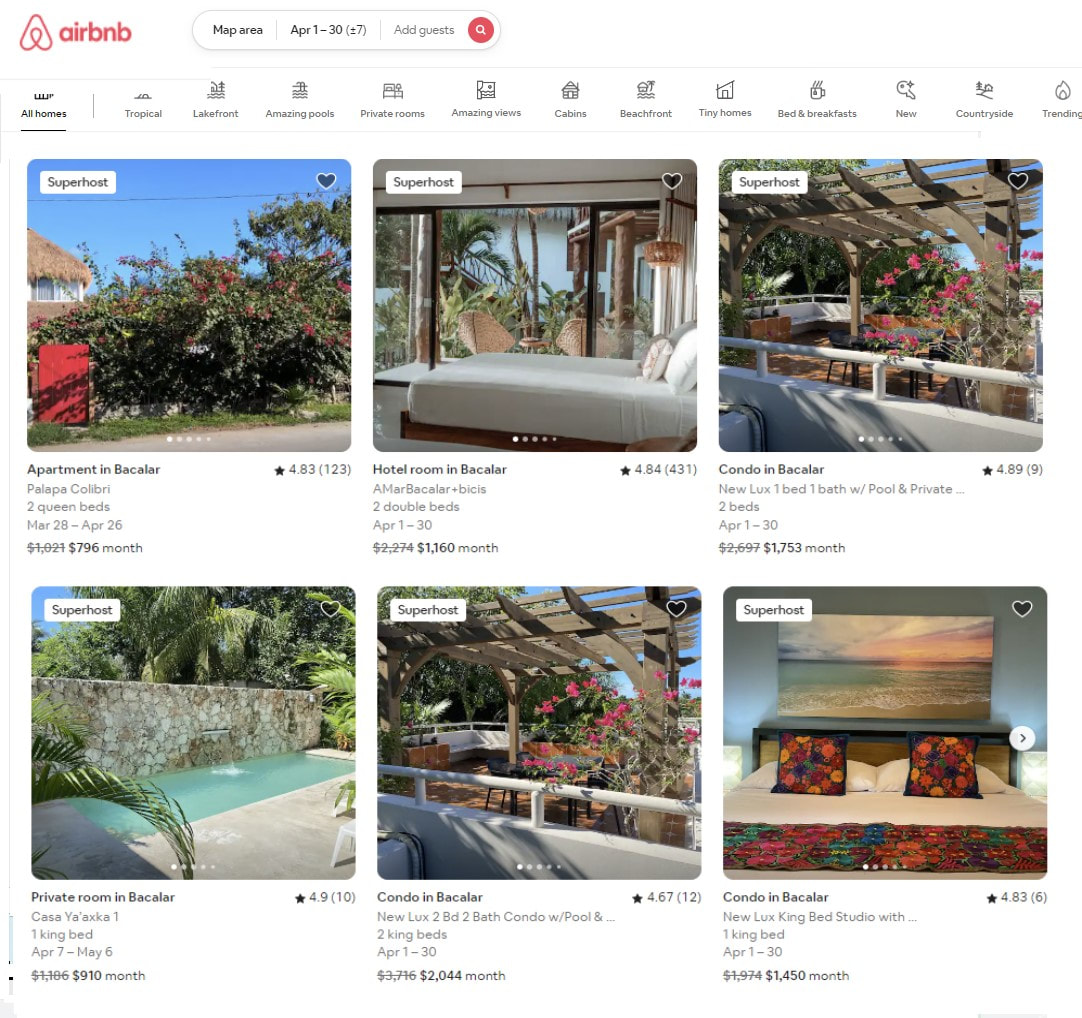

This can prevent unwanted individuals from having access to your private information, and it also cuts down on spam, unwanted mailings, and solicitations from businesses and individuals trying to sell you things when you open a new business (one of my pet peeves!). All the major cities in Nevada (Las Vegas, Reno, Carson City) host several popular incorporation and mail forwarding services targeted towards expats and snowbirds that make transferring residency and setting up a corporation or other entity in Nevada very easy to do. Corporations and LLCs do have to file an annual list every year, which costs several hundred dollars, but can be filed online. If you don't have a corporation or an LLC, then it is much cheaper. In Las Vegas, for example, a home-based sole proprietorship or general partnership costs nothing to set up, the business license is free. And there are no state-level tax return filings in Nevada. Nevada also has the benefit of several big cities and a wide range of climate and terrain. In Tahoe, you can enjoy beautiful mountains, skiing, fresh air, and the beautiful Lake Tahoe for fishing or water activities. If you like nightlife, or if you like live events, concerts, parties and gambling, there's Las Vegas. And everything in between. Florida and Texas are close seconds, and preferable to Nevada in terms of climate if you want to live in the states at least part-time. Florida and Texas impose no personal state income tax, but they do have some types of franchise/corporate tax on a businesses' gross income. Florida imposes a 5.5% corporate income tax. In Texas, businesses with $1.18 million to $10 million in annual receipts pay a franchise tax of 0.375% on their gross receipts. Alaska isn't a bad choice, either. There's no personal income tax, but there is a corporate tax. Alaska imposes a corporate tax ranging from 0% to 9.4%, spread across ten tax brackets. It's also less accessible than any of the lower 48 states. Actually getting to Alaska if you need to do anything related to your residency requires a long drive and a border crossing, or an airline flight over Canada. And the harsh Alaskan winters are not for the faint of heart. But to be fair, there are many people who love Alaska's unspoiled wilderness. Plus, the summers in Alaska are rumored to be absolutely spectacular. Wyoming is also another good choice, from a tax perspective. This state also imposes no personal income tax, but the landscape is isolated and rather bleak, (I've driven through the whole state and there isn't much to see in Wyoming). So if you're not planning to actually live there at least part of the year, Nevada is a better choice in terms of privacy as well as tax benefits. Imagine a place where the sun shines almost every day, the water is crystal clear, and the locals are warm and welcoming. That place is Bacalar, Quintana Roo, Mexico. This beautiful town is located in the lush, tropical Mexican state of Quintana Roo and offers a wonderful mix of Mexican culture and Mayan paradise. It's conveniently located about 30 minutes from the state capital, Chetumal, which hosts every store with any modern amenity you could possibly need, including Wal-Mart, Costco, and Home Depot. There are also modern, affordable hospitals in Chetumal, in case you need medical care. So if you're ready to say goodbye to cold winters and stressful commutes, it's time to explore retiring in Bacalar, Quintana Roo, Mexico. Qualifying for a Retiree VisaIf you are planning on moving to Mexico to retire, the first step is to research the different visa options and requirements. The retiree visa is a very popular choice for those who want to enjoy their golden years in Mexico. A retired couple can retire very comfortably in Mexico with an average income of about $2,500 a month, or $30,000 a year. For retirees who want to live in Mexico, the first stop is to visit the nearest Mexican consulate and apply for a permanent resident visa. Finding a Home and Settling in Bacalar, Mexico Although there are expensive hotels and pricey waterfront homes, Bacalar is a very affordable place to retire, if you manage your living expenses correctly. Finding a home in Bacalar, Quintana Roo, Mexico is relatively easy. With a wide range of housing options available, from waterfront condos to homes in town, you're sure to find something that suits your budget and your needs. Using a service like Airbnb or Facebook marketplace, you can find short term rentals as low as $19/night. Monthly rentals range from less than $500 per month for a small studio to several thousand for an entire home near the lake. The closer you rent to the Bacalar Lagoon, the higher the price will be. You can choose to rent or buy and there are plenty of real estate agents in town who can help you find the perfect place. Some sample prices for a monthly rental on Airbnb are shown below. This search was for the entire month of April 2023 and it's just a sample of the range of different prices that you will see for a monthly and/or short-term rental. Enjoying the Local Scene and Living the Good Life in BacalarYou will find a warm and welcoming Mexican community in Bacalar. The locals are friendly and generous, always willing to share their local culture with foreigners. You will be able to experience the real Mexican way of life, from the fabulous local cuisine to traditional celebrations.

Eating out is affordable and you can find fresh fruits and vegetables at the local markets. Plus, there are plenty of activities like scuba diving, horseback riding, lake tours, diving and fishing trips and more that you can enjoy while living here. If you’re looking for a place to retire that offers a lower cost of living, good healthcare, and plenty of activities and amenities, Bacalar is a great choice. And with a retiree visa available to those over the age of 50, it’s easy to make the move. 1. Easy Residency for Retirees: Costa Rica's rentista visa is the perfect option for retirees looking to move to Costa Rica on a long-term basis. The rentista visa, also known as retiree visa or pensionado visa in Costa Rica, allows its holders to stay in the country with no time limit and to work without limitation.

The rentista visa can be easily obtained by demonstrating stable, passive income such as rent or dividends from stocks and bonds. The rentista visa stands out among other visas because applicants do not need to demonstrate any form of employment in Costa Rica. To apply for the rentista visa, applicants must show a secure monthly income of at least $1,500 USD plus an additional $500 USD for each dependent over the age of 18. The rentista visa also offers several benefits to its holders, such as access to healthcare and discounts on purchases from various retailers including restaurants, hotels, and entertainment services. Additionally, rentista visa holders are eligible to apply for permanent residency after being a rentista visa holder for three consecutive years. Applicants are required to apply for residency at the Immigration Office of Costa Rica. It is recommended that you hire an attorney to go through the application process. 2. Low Cost of Living: One of the biggest benefits of retiring to Costa Rica is its low cost of living. With a lower cost for basic necessities like food, housing and transportation, retirees can stretch their retirement savings further than in many other countries. 3. Great Climate and Natural Beauty: Another great benefit for those looking to retire to Costa Rica is the country's climate. With an average temperature ranging from 66°F (19°C) in San Jose up to 80°F (27°C) along the coastlines, you won't have to worry about extreme temperatures or harsh weather conditions that can be found elsewhere around the world. And the country offers any type of scenery that you might desire, from stunning beaches on both coasts and lush rainforests full of exotic wildlife – there’s something to keep you entertained and exploring year-round. 4. Affordable Health Care: For retirees considering moving abroad, one of the most important factors is access to affordable health care services and treatments; fortunately, Costa Rica has both! The country offers quality medical care at a fraction of what it would cost in other countries with some procedures costing as little as 1/10th compared with US prices! 5. Tax Benefits: Costa Rica offers some of the most attractive tax benefits for retirees looking to move abroad. Retirees can take advantage of income tax exemptions, tax credits on insurance premiums, and other expenses that make living in the country much more affordable. 6. Friendly People: One of the great things about Costa Rica is its friendly, welcoming people. Locals are generally warm and accommodating to both locals and foreigners alike, making it a great place to meet new people and make friends. 7. Easy Accessibility by Air: Costa Rica is easy to reach via air travel with direct flights from the US and Europe to multiple destinations throughout the country. It's also easy to travel within Costa Rica with a variety of transportation options such as domestic airlines, ferries, and buses. The cheapest month to fly to Costa Rica is January, but affordable flights can be obtained year-round if you book in advance. There are many non-stop flight options to Costa Rica from major cities in the United States. British Airways has also recently launched direct flights from London (LGW) to San Jose (SJO). 8. Central Location: Another great advantage of retiring in Costa Rica is its central location. From here you can easily explore other countries in Central America or take a quick trip to North America or Europe when you need a change of scenery. 9. Low Crime Rate: One of the biggest concerns for retirees looking to move abroad is safety and security – luckily Costa Rica has one of the lowest crime rates in Latin America. Costa Rica has a strong social safety net, an emphasis on education, and a commitment to democracy and the rule of law. Costa Rica has historically had one of the lowest homicide rates in the world, with only 4.7 murders per 100,000 people. This is a marked contrast to other Central American countries like Nicaragua and Honduras, which had homicide rates of 10.6 and 42.8, respectively. According to data from UN-Habitat, the country has a rate of only 7 violent assaults per 100,000 people. This is far lower than other Central American countries like Guatemala (50) and El Salvador (69). The country also benefits from its geographic location; Costa Rica is surrounded by the Pacific Ocean and Caribbean Sea, which can make it difficult for criminals to enter or leave the country. The country’s national police force is well-regarded and very effective at keeping crime rates low. 10. Stable Economy: Costa Rica has a stable economy and is one of the most affluent countries in Central America. The currency is strong, making it easy to budget for living expenses and plan for your future. Plus, you can count on the government to remain financially solvent so you never have to worry about your investments or savings. Costa Rica is an amazing destination for retirees who are looking to make a new home abroad; with its low cost of living, great climate, affordable health care and tax benefits – it's the perfect place to start your life anew. Plus, its stunning natural beauty and friendly people will help you feel right at home! Those looking to move their lives somewhere else without all the hustle and bustle and severe temperatures of Canadian or Northern U.S. winters, Panama may be one of the best destinations to relocate. With its warm climate, welcoming culture, and low costs of living, this Central American nation is quickly becoming one of the most popular expat destinations in the world. Another big benefit of Panama is its location. Situated at the crossroads of Central America and South America, Panama is an excellent base for exploring both regions. You can easily travel to Costa Rica, Mexico, Colombia, and other nearby countries. And with its highly developed infrastructure, getting around Panama is a breeze. Panama is a great place for entrepreneurs and business owners. The country has a strong economy and a friendly business environment. English is widely spoken, and there are plenty of co-working spaces and other resources for digital nomads. Every year a growing number of so-called snowbirds embark on their journey southward towards Panama in search of adventure and a different lifestyle. From applying for the dizzying array of different visas available, and physical relocation of your possessions, the process can be daunting; however there are many services available that take the stress off would-be expats looking to start a new chapter in Panama. Several key benefits make relocating to Panama an attractive option for more and more expats. The country's vibrant culture, stunning scenery, and abundance of opportunities make it an ideal destination for anyone looking to live their best life! So if you're ready for more sun and sand in your future, read on! Enjoy a lower cost of living in Panama!In Panama, you can enjoy beautiful beaches, rich culture, and delicious food—without breaking the bank. In Panama, you can get more bang for your buck! There are many reasons why retirees might choose to move to Panama. Perhaps the most obvious benefit is the country's warm weather, which makes it a pleasant place to spend one's golden years. In addition, Panama is a very affordable place to live, with a cost of living that is much lower than in most other developed countries. This includes both living expenses and healthcare costs, which are often a major concern for retirees. Panama has a much lower cost of living without sacrificing on quality or standard of living. Prices for housing, groceries, transportation and other amenities are significantly cheaper in Panama compared to the United States, Canada, and most of Europe. Panama also offers a wealth of activities and amenities that expats can enjoy. The country is home to beautiful beaches and rain forests, providing plenty of opportunities for outdoor recreation. If you prefer city life, Panama City is a vibrant and cosmopolitan city with plenty of restaurants, theaters, and other cultural attractions. And thanks to Panama's strong economy, expats (especially retirees) can feel confident that their money will go far in this country. Initial Entry into PanamaThere are a few requirements for entry into Panama. You must have a valid passport, visa (if required), and proof of onward travel. You must also have a return or onward ticket. Canadians and Americans can enter the country without a visa and stay up to 180 days. Citizens of the European Union and many other countries can enter without a visa and stay for up to 90 days. If you're not a citizen of a visa-exempt country, you'll need to get a visa before you arrive in Panama. The best way to find out what you need is to contact the embassy or consulate of Panama in your country. Consider a Panamanian retiree visa if you qualifyA retiree visa in Panama has many benefits. This is also called the "Pensionado Visa." The retiree Visa only requires that applicant demonstrates an income or pension of only $1,000.00 USD per month and $250.00 USD for each dependent.

For one, it gives you permanent residency in the country, which means you can live there indefinitely. You don't have to worry about renewing your visa every year or so. Additionally, it gives you access to all of the social services that the country has to offer. This could include healthcare, education, and other benefits. Panama is a very safe country with a stable government, making it a great place to call home. If you're thinking of retiring abroad, Panama should definitely be at the top of your list. With its many benefits and appealing lifestyle options, it's hard to go wrong choosing this Central American country as your new home. |

No website or company has paid a fee to be mentioned in this blog. Any suggestions you see are based solely on our own experiences and personal preferences.

About UsJust a middle-class family with three young kids, looking to escape the rat race. This is our journey! If you have a question for us, please contact us directly using our email here.

Archives

May 2024

|

RSS Feed

RSS Feed